- Rule of Acquisition

- Posts

- Extraordinary Companies portfolio is up 74%

Extraordinary Companies portfolio is up 74%

Should I start an investment fund?

Dear Investors,

I’m baaack!

This is a famous line from the movie Independence Day, but you don’t remember it. Unfortunately, now you’re intrigued and have to watch the clip on YouTube.

(Sorry I’ve made you do this).

I’ve been quiet for a few weeks. I was thinking about what’s next for me.

I’ll tell you about it below and give you an update on the Extraordinary Companies portfolio.

What’s next for me?

Extraordinary Companies performance update

Money growing on trees… or the other way around?

What’s next for me?

Every now and again someone will ask if they can invest with me.

I always turn them down because financial services is highly regulated, and you have to set up regulated fund if you want to work with the public.

I’ve been considering setting up a fund, but fund management is not an easy business.

It is highly regulated and that comes with high levels of fixed costs for compliance. It is also highly competitive - there are a lot of funds in every country. Here are the number of funds in selected countries:

USA: 7000

European Union: 6200

United Kingdom: 4000

South Africa: 1700

India: 4000

Hong Kong: 2000

Australia: 6500

Clearly, there is no shortage of competition.

But let’s ignore a “few” competitors because every investors thinks they can do better than everyone else. Instead let’s look at the real challenges facing a new fund.

Assets Under Management (AUM)

Assets Under Management means how much money you are managing.

Fees for active management have been under pressure for decades. This is driven by the rise of passive investing, where investors can buy the index instead of picking stocks. Passive investing is cheap because you don’t have to analyse anything. All you have to do is buy what is in the index, in the same proportions.

This is dumb money - no thinking goes into stock selection. But that doesn’t matter to investors because it is cheap (i.e. low fees).

In order to compete, active fund managers have lowered their fees. Unfortunately they can never get as low as a passive fund.

To maintain profitability, their only solution is to manage a large amount of AUM at a low fee.

Sounds good.

Maybe not.

This pressure on fees makes starting a fund challenging because it is a loss-making business until you have significant AUM.

Then when the cash comes in, size becomes it’s own anchor. The performance of the fund drops as the AUM gets larger. This is due to challenges with investing huge amounts, it tends to have to be invested in large companies. As a result, the fund ends up looking a bit like the index.

And we’re back to the question of why pay higher active management fees when you can own the index cheaply?

Vintage

In the private equity industry vintage refers to the year a fund starts investing. Typically the future performance of the fund is highly influenced by its vintage.

If a private equity fund starts when the market is booming, asset prices are higher. That makes subsequent returns lower (bad for you).

Applying this concept to a mutual fund, if you start investing when the stock market is high, then it is likely that your future returns will be average.

Obviously the best time to start a fund is after a market crash. Prices are low and in time, the fund will do well.

But that comes with its own problems. The first of which, is who is going to wait for a market crash before starting a fund? The last big downturn was in 2008 (17 years ago).

The second problem is human nature, which I will discuss below.

People are naturally terrible investors

When markets are crashing, investors bail out as quickly as possible and are scared to invest. That makes a market crash a terrible time to launch a fund. No one wants to invest in it.

Conversely, investors love it when the market is booming (like it is now). They throw money at anything and everything. Think back to the hot stocks in our last newsletter - most of those companies were not profitable.

What behaviour are investors exhibiting? Buy-high, sell-low.

Everyone knows you can’t make money doing that, yet investors keep doing it.

But why do they make this mistake over-and-over again?

Because human nature makes investors oscillate between the emotions of fear and greed. Neither of which is good for your investment returns.

Should I start a fund?

Back to the question, should I start a fund?

I don’t have an answer yet.

What do you think, should I start the Extraordinary Companies Investment Fund?

Extraordinary Companies portfolio

Let’s take a quick look at the portfolio.

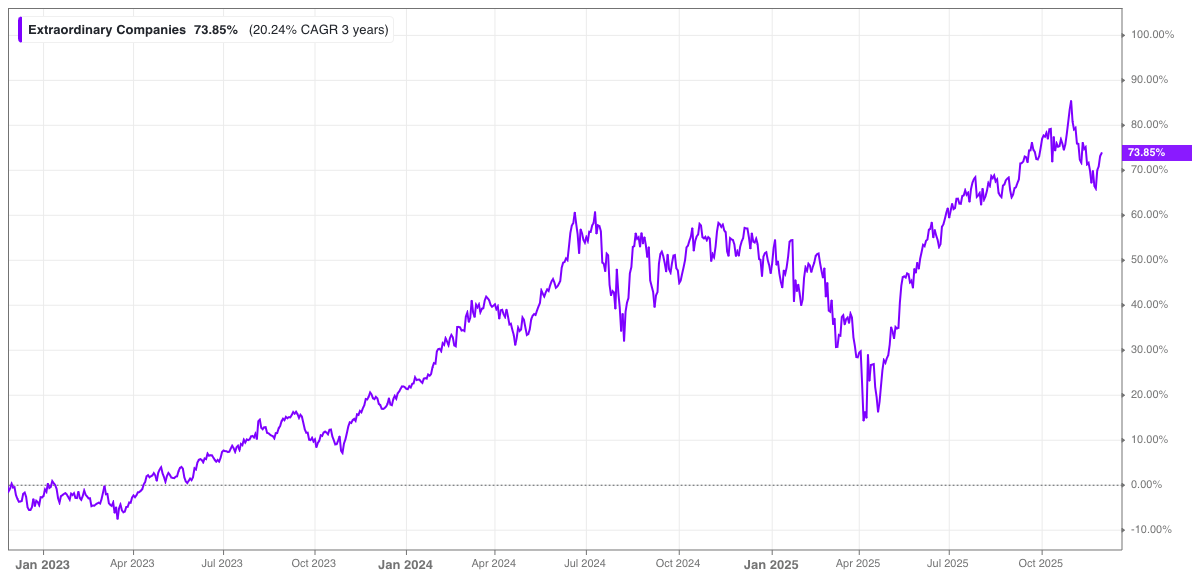

The Extraordinary Companies portfolio performance is 20.2% per annum, over the past 3-years.

That’s about the same as a few months ago, although it was up to 25% per annum in between. That’s the recent spike in the graph below.

Extraordinary Companies 3-year portfolio performance

There have not been any changes to the portfolio companies since the last update.

While that doesn’t make for an action packed newsletter, one of the benefits of buying high-quality businesses is that you can simply own them. You don’t have to trade continually.

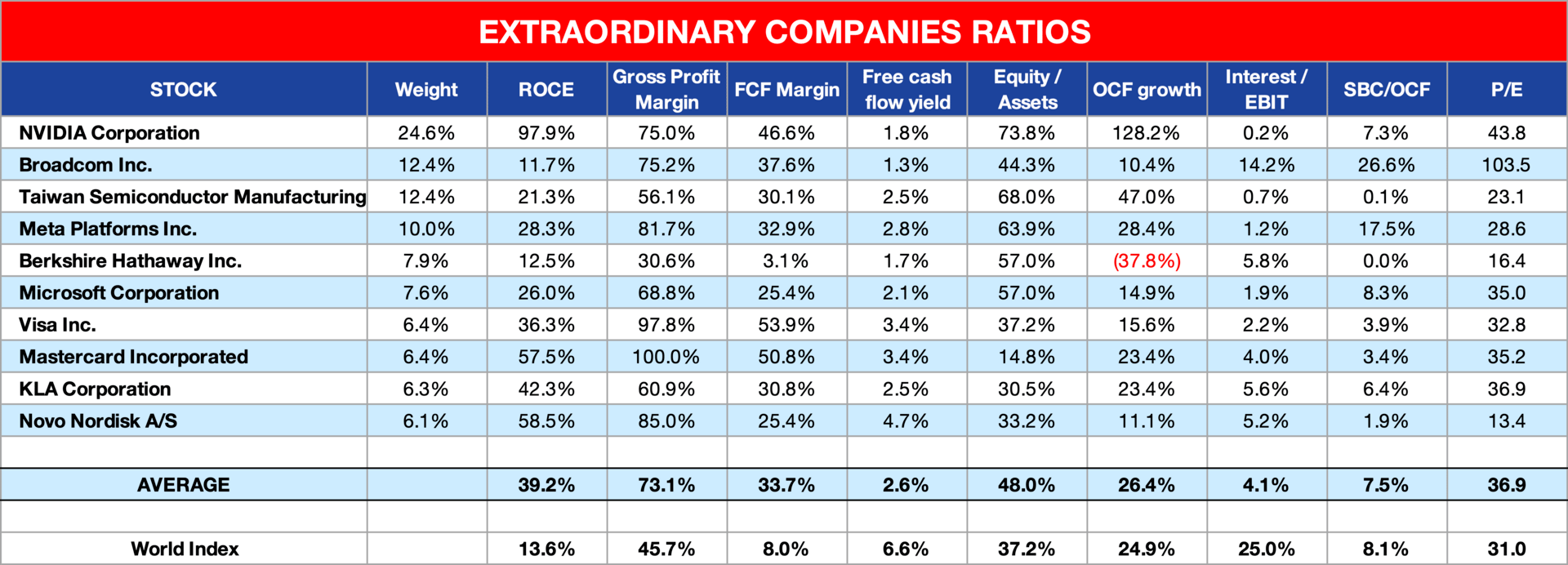

Here’s the entire portfolio with relevant ratios for each company. If you compare them to the World Index, you will notice that we own higher quality companies. Consequently, they are a bit more expensive, as indicated by the higher P/E ratio.

Extraordinary Companies portfolio ratios

Until next time…

I’ll be back!

(This time, you know the line is from the movie Terminator)

Reply