- Rule of Acquisition

- Posts

- The ROA Watchlist portfolio is up 535%

The ROA Watchlist portfolio is up 535%

33% per annum growth

Dear Investors,

Time for a look at the good ol’ ROA Watchlist portfolio.

The markets have been rising over the past few months and the portfolio has benefited.

Let’s see what happened.

Portfolio performance

Company financial ratios

Conclusion

Investor laughing all the way to the bank

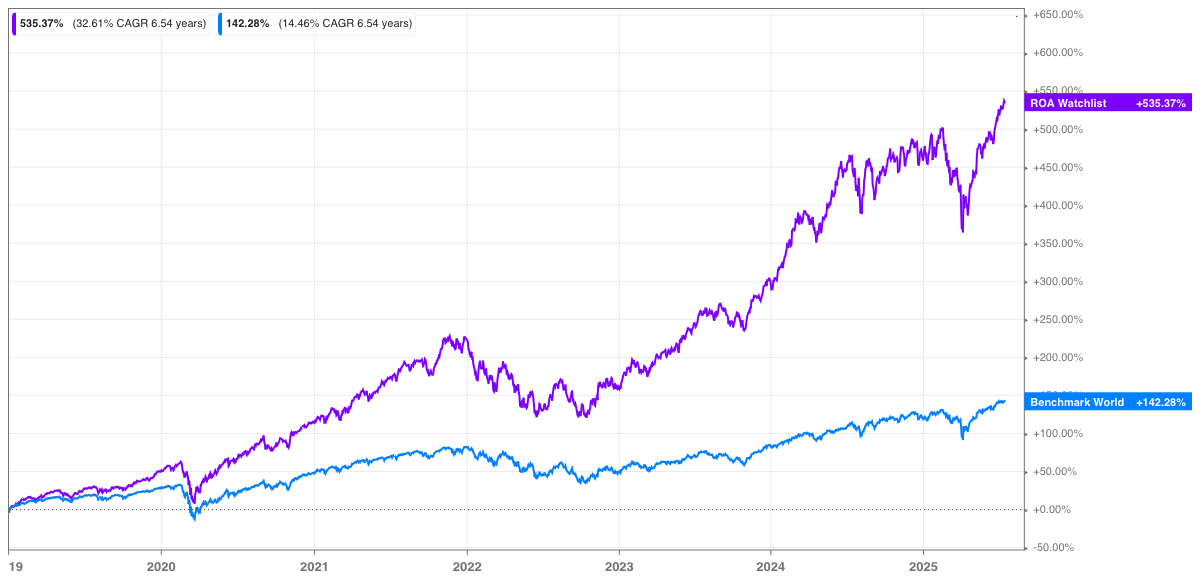

ROA Watchlist performance

In the graph, the purple line shows the performance of the ROA Watchlist portfolio and the blue line shows the performance of the World Index.

If you had been a long-term holder of an equally weighted portfolio comprising the ROA Watchlist companies, a $100 000 would have become $635 000 (since 1 January 2019). The same amount invested in the World Index would have become $242 000.

ROA Watchlist vs World Index

As the table shows, the ROA Watchlist continues to outperform in all periods. Over 1-year the performance for portfolio is back in the teens, which is where you would expect it to be. Returns over 30% are phenomenal and usually not sustainable in the long-term.

Aw, are you sad to hear that?

Well not even Warren Buffett has generated that level of return - he is averaging 20% per annum over 60 years. Peter Lynch almost did it, his return was 29.2% per annum over 13 years.

But let’s be honest, most people aren’t going to work like Peter Lynch did. He was working weekdays and weekends for 13 years and even leaving his family to do company visits while on vacation.

Return period | ROA Watchlist | World Index |

|---|---|---|

1-year | 16.5% | 14.3% |

3-years | 39.0% | 18.4% |

5-years | 30.0% | 14.0% |

Since 1 Jan 2019 | 32.6% | 14.5% |

Financial ratios

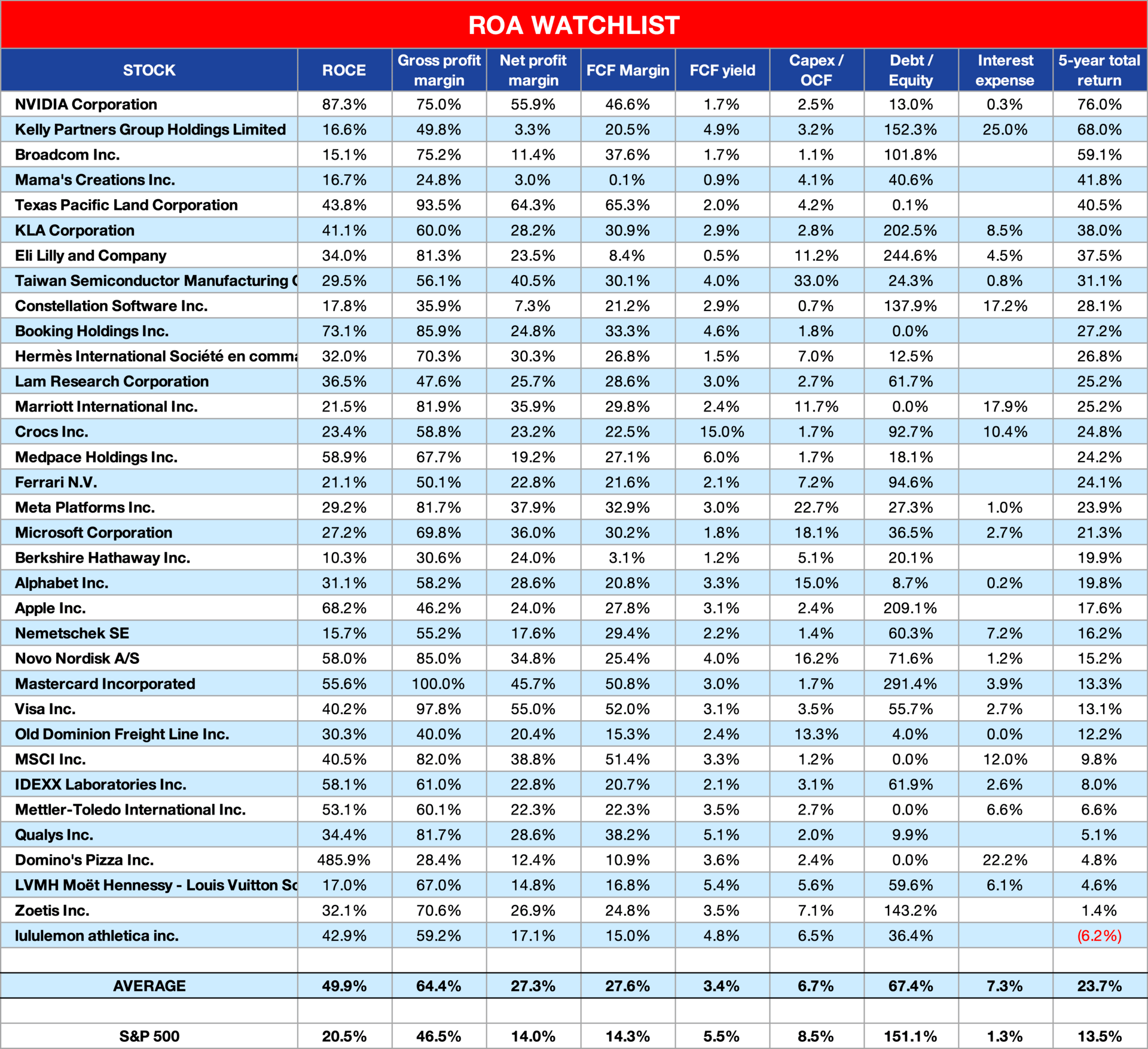

The table below is ordered by 5-year annualised return. Highest returns at the top, lowest at the bottom.

The ROA Watchlist was created by looking for extraordinary companies, not by looking at which companies did best on the stock market. As the list shows, on the whole great companies give great returns (if you don’t overpay for them).

Here’s a few notable points about the ROA Watchlist companies:

Thirty four companies are on the list.

Seven companies delivered average to below average performance - meaning less than 10% per annum return.

One company delivered a negative performance - Lululemon.

That means 28 out of 34 or 76.5% of companies had superb performances.

ROA Watchlist - July 2025

Conclusion

The ROA Watchlist is a diversified portfolio. It is diversified amongst industries and countries, although it does have a U.S. bias, since that is where many of the best companies are located.

The stock market has crazy movements in the short-term - politics, war and economics all affect it.

But notice how those problems disappear if you own companies for a long time. Over the past six and a half years, all but one of our companies went up in value - that is a 97% success rate.

The lesson is that you improve your odds in investing if you stick with it for a long time. Patience can make you look like a stock market genius.

So, keep it simple stupid.

Reply